In the early days of strategic outsourcing, companies were most comfortable hiring away low-skill tasks distant from sensitive business areas. Nowadays, many companies do the opposite and outsource critical functions such as customer service and money-management tasks. This has grown to include many activities normally performed by administrators or human resources departments—including payroll duties. By outsourcing payroll, you are giving up direct supervision of at least some of its processes. Even though a client company is responsible for setting expectations and monitoring a provider’s performance, there’s no substitute for the level of oversight achievable by managing payroll functions internally.

- A lack of coordination for deliverables negotiated in multiple contracts is another common challenge.

- If you fail to meet these requirements, the penalties can be complicated and steep.

- Payroll service providers have specialized expertise in payroll processing and tax compliance.

- It also removes the need for manual data transmission, making things more efficient and secure.

- In 2023, a wide selection of “payroll outsourcing providers” are to be found both domestically and internationally.

- While the general rule of thumb is that it will cost around $200-$250 per employee per year, your total price will be based on the scope of your engagement with your vendor.

At times, business leaders may fear that outsourcing payroll services could create more work for their teams in the long run. OperationsInc payroll experts do the opposite by serving as a liaison between you and your payroll provider, relieving you of the burden that vendor management tasks would impose. You can rest assured that you’re offloading the responsibilities of payroll to seasoned professionals, freeing you up to focus more on strategic activities. When you choose OperationsInc, you aren’t going to have a nameless “help desk” serving you — you’ll have dedicated experts on call, who know your specific needs, to provide any payroll assistance you require. Preventing employee data from being compromised is crucial, as attacks can lead to identity theft. Many payroll providers use cloud-based systems that automatically issue monthly scans, install antivirus software, and encrypt client data.

Expertise and specialized knowledge

Therefore, taking a new approach with the help of third-party expertise and technology could be a real game-changer for your enterprise. Coordination issues – coordinating a multi-country payroll outsourcing vendor relationship is always challenging. But it is made especially risky and arduous when an aggregator model is used. Sourcing a local vendor for each country makes sharing knowledge and coordinating tasks across geographies complex and time-consuming.

- These mistakes can negatively affect your employees and ultimately result in employer/employee strain.

- When choosing a provider, you want to find one that is quickly and easily integrated with your current payroll process.

- In the early days of strategic outsourcing, companies were most comfortable hiring away low-skill tasks distant from sensitive business areas.

- Whether it’s calculating payroll amounts, generating in-house reports, preparing and remitting state and federal payroll taxes and returns, or simply printing, signing, and distributing paychecks, the demands on your time can be costly.

When your company is ready to grow internationally, you’ll need dependable ways to pay your remote global team members. However, the price must align with the company’s objectives and performance expectations. As mentioned above, it is extremely important to ensure that all company and employee information is protected and to establish confidentiality and data protection policies and agreements. Schedule a consultation with Paypro today to see if payroll outsourcing is right for you. Consider what previous customers have said about the provider by checking out reviews of their services or requesting client references.

Resources

With a multi-country payroll solution, businesses set up automated, on-time payments, enabling accurate and consistent payroll, regardless of the employee’s location. This provides one centralized solution for processing payroll in multiple countries. Emergency payroll services from OperationsInc will help you manage any skills gap left by the departure of a seasoned payroll specialist. Our interim management includes all payroll administration, processing, and submission services, as well as vendor liaisons, employee setup or termination, custom reporting, compliance reviews, and more. Our team has extensive experience with more than 20 different payroll technology providers, including ADP, Paychex, Paylocity, Paycom, Paycor, Ceridian, Workday, and Namely.

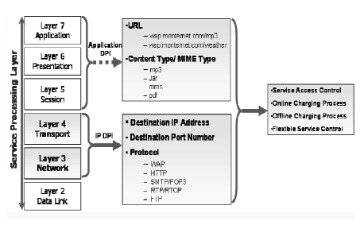

It involves both submitting documentation to tax authorities and remitting the tax dollars. If your company already has an existing Human Resource Information System (HRIS), working with a payroll provider whose technology can work with your system will make things much easier. Look for providers whose software is compatible with yours or can be easily integrated with an API, otherwise, you may have to migrate your entire system over to theirs or manually provide them with data during each pay cycle.

“Payroll co-sourcing” describes a hybrid model in which some elements of the payroll process are hired away while others are completed in-house. One advantage of splitting up the responsibilities is that companies can get “hands-on” in specific areas they’d rather not entrust to a third party, all while still enjoying some of the cost advantages of outsourcing. Somewhat to the contrary, other companies co-source payroll duties if they believe an external service will be more adept at specific tasks, keeping the process in-house except for when they’d rather turn to an expert. Working with a payroll provider with the knowledge and expertise of the local regulations and changes in the legislative environment is vital. Especially for multinational companies that need to manage payroll for employees in various locations. Finding a provider that can supplement their payroll solutions with high-quality, personalised customer service also makes a world of difference.

Ensure Disclosure and Financial Integrity

It is common to use the terms “payroll service provider” and “payroll services” to refer to either type of organization. For business leaders, leaving global payroll to the experts reduces the chances of a mistake being made in areas which could result in hefty penalties and fines. It also means spending less time in-house on complex payroll or tax issues, and more time on building sales and marketing strategies, and improving workflow efficiencies. By outsourcing payroll to a reputable provider, owners have more time to focus on what matters most to them. In many cases, they’ll also have a variety of options available to maximize time saved throughout the pay period.

For example, updates made by HR such as promotions, redundancies, or terminations are automatically made available to payroll, saving time in both departments and dramatically reducing the opportunity for errors to occur. Organizations are better protected in this way, as the information used for running payroll, tax filing, and benefits calculations is free from discrepancies. Companies still need to set time aside to coordinate Journal Entries for Bad Debts Accounting Education certain tasks and activities with their payroll providers, which can prove time consuming. They also need to provide ongoing support to ensure the third party achieves the desired results. Payroll outsourcing is a service offered by an external entity that provides legal, tax, and accounting support to companies to ensure that employees receive their paychecks on a timely and accurate manner, and with minimal risk.

International payroll outsourcing is the process of partnering with a payroll provider to accurately and compliantly pay foreign contractors and employees, no matter where they’re located. Even if you have historically managed payroll without experiencing any significant issues, you may be creating an unnecessary burden by keeping the process in-house. By contrast, opting to outsource payroll to the expert team at OperationsInc will ensure that you maintain an accurate and timely payroll and optimize the efficiency of your compensation processes. With an effective payroll outsourcing partner, you save considerable administrative time and reduce expenses while focusing on your core business operations.

When all goes well, hiring out the work can provide significant advantages and cost savings. It’s important to note that payroll outsourcing providers charge in different ways, and that they can take on some or all of the payroll process, so cost-benefit analyses will vary based on goals and budgets. Small businesses that outsource their payroll will see immediate cost-saving results in two ways. One of those is the reduced cost of overhead that would usually come from hiring and offering benefits to someone who is specialized in this service, along with training the right payroll professional. It’s not uncommon that even an experienced payroll administrator needs time to be trained.

Save on time and cost

When you have a global team, ensuring that all of the payroll tasks mentioned above are processed correctly and on time can get hectic. Therefore, outsourcing payroll in such a scenario will help you focus on your core business operations and help you hire the right people globally. You must also consider the time taken and the cost you incur when setting up a local payroll team. If the time taken to process payroll and the costs are high and cannot be justified, outsourcing payroll to an external payroll provider is the best bet.

If you need help in finding the right outsourcing partner, book a FREE APPOINTMENT with Outsource Asia experts today. So the question of whether or not to outsource may still weigh heavily on your company’s mind, but just remember these four areas where outsourcing can really make a difference. This is so that you don’t run into any non-compliance risks that might result in harsh penalties, reputational damage that can compromise the good standing of your company, and revocation of licenses.

Some payroll companies offer additional features such as time and attendance tracking, applicant tracking, benefits enrollment, etc. These capabilities can save time, cut down on costs, and increase efficiency and security. Finding a high-quality outsourcing solution can make payroll management simpler and decrease the chance of mistakes.

The reason for the savings is that you as the employer take on more responsibility in the payroll process, such as employee maintenance, payroll detail entry, and report production. These solutions are also paperless so by paying your employees with alternate methods such as direct deposit, you don’t incur costs for things like check delivery. When considering the payroll outsourcing cost your business may incur, it’s important to understand exactly what’s included. This allows you to make accurate comparisons between companies and have a clear picture of what you’ll be paying. PEPM is a good choice for companies who may have additional payroll runs for things like bonuses or commissions. In addition, for companies with a predictable number of employees paid each month, a PEPM pricing solution makes budgeting for the outsourced payroll cost very easy.

But the day-to-day difficulties that your organization may face can make payroll administration and management burdensome and complex. As an employer, it is crucial to understand the responsibilities of paying your employees. An incorrect payroll process can turn out to be expensive and would lead to legal and financial trouble. Depending on your business requirements, you can customize the payroll services you want to outsource while retaining control of certain aspects. As you can see, there are many factors that can impact the total cost of payroll processing.

While the general rule of thumb is that it will cost around $200-$250 per employee per year, your total price will be based on the scope of your engagement with your vendor. Some payroll companies may include one or more of these services in their base fee. For example, at Complete Payroll Solutions, we include per-pay period and quarterly tax filing, employee pay options, and check stuffing and sealing as part of our standard base fee. But most often, you have to pay a separate fee for each add-on or buy a package that includes several popular services. The benefits of outsourcing payroll can be extensive, but the critical element of realizing these benefits is hiring the right provider.

Velocity Global’s Employer of Record (EOR) solution helps businesses quickly transition into new markets and conduct complex operations like international payroll with far less risk. International payroll platforms typically rely on cloud-based software to store data and complete payroll. While these platforms have security, including firewalls and encrypted servers, they are a prime target for cybercriminals. For payroll, relying on software can become a major issue if certain platforms are breached, and employee data is stolen or corrupted. Use this guide to discover how to pay global talent using international payroll outsourcing.

We can also manage or assist with HRIS integrations and launches, setup self-service portals and other employee experience interfaces, handle year-end management, document transfers, payroll system optimization audits, and more. Another potential way to save on your overall payroll costs is to see if a payroll provider offers bundled options or packages. As we discussed, many vendors provide other complimentary solutions to help you manage your workforce such as benefits and HR consulting services.